Personal finance

Create personal finance budget plans to track household expenses with free customizable templates from Microsoft Excel.

Manage income and expenses effectively with personal finance budget templates in Excel

Save time in organizing your personal finances with a wide range of free online templates. Easily edit expense categories for fixed costs and discretionary spending and set spending limits for specific categories to put budgeting strategies into place.

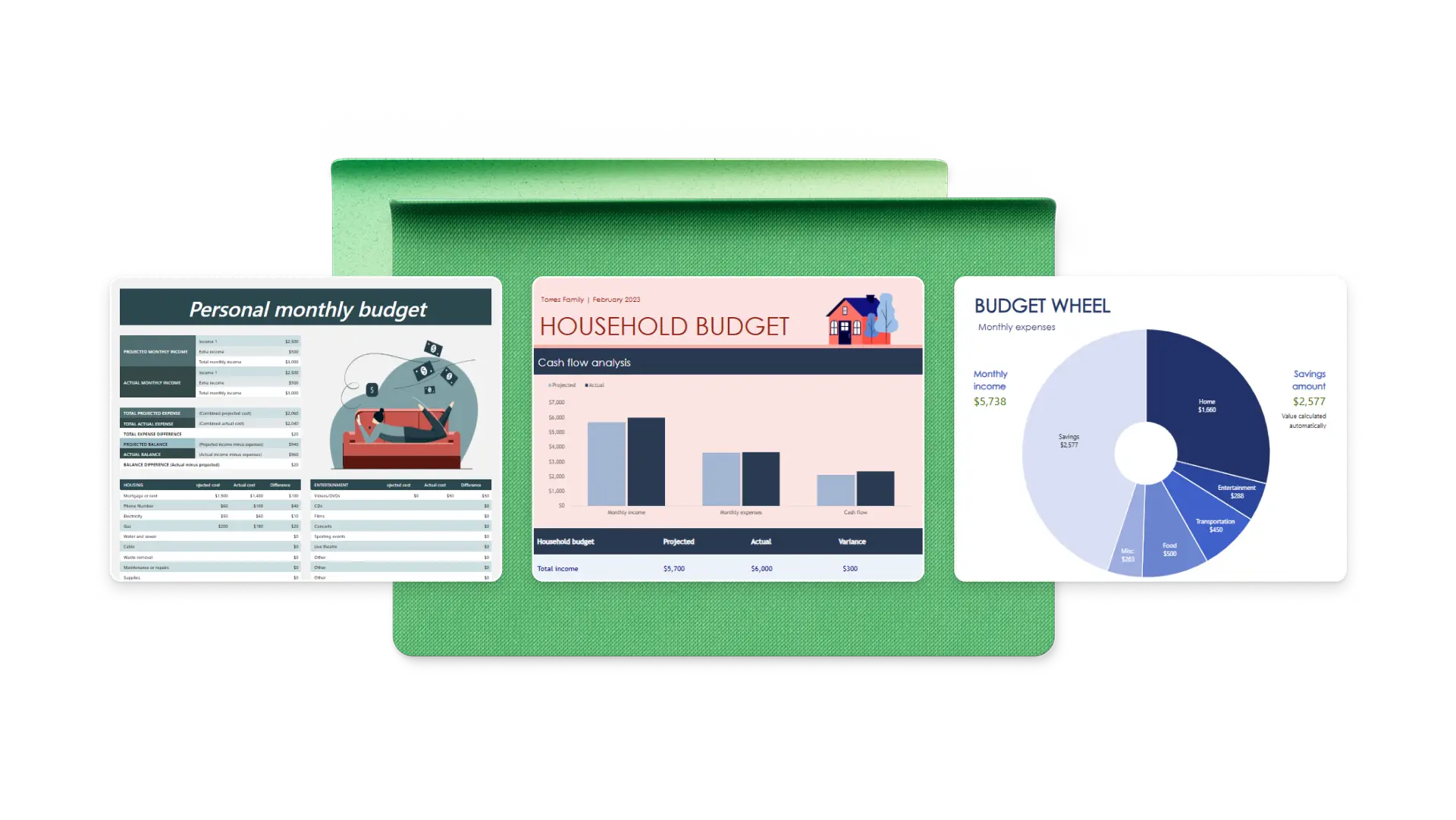

Customize personal finance templates

Choose from personal budget templates for professionals, students, and families, with monthly and annual timeframes. Start with built-in income and expense trackers. Freely edit expense names and categories.

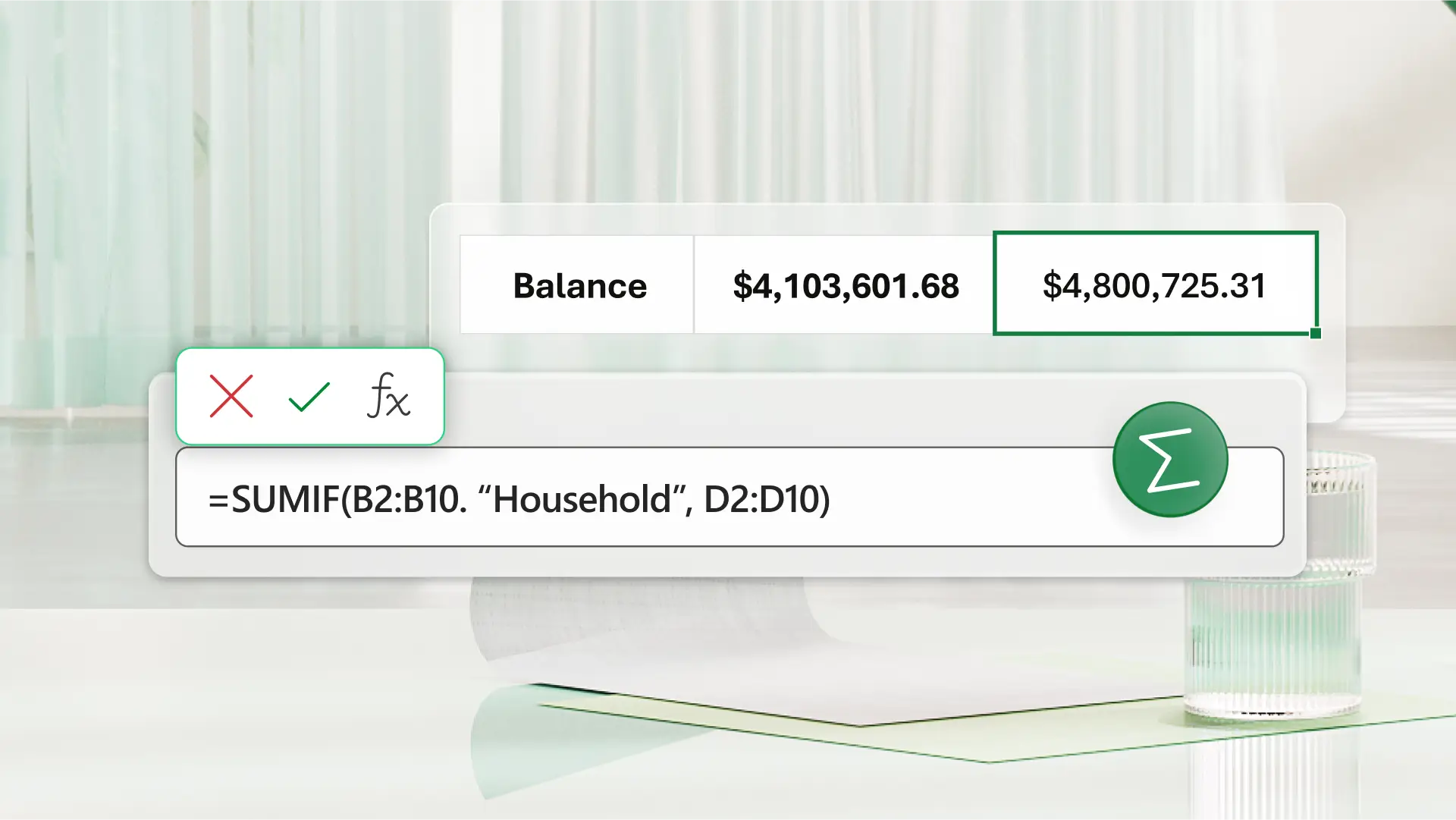

Add financial data

Open a CSV from credit card or bank statements in a connected sheet and assign categories to each transaction. Use SUMIF spreadsheet formulas to total expenses for each category as you add transactions.

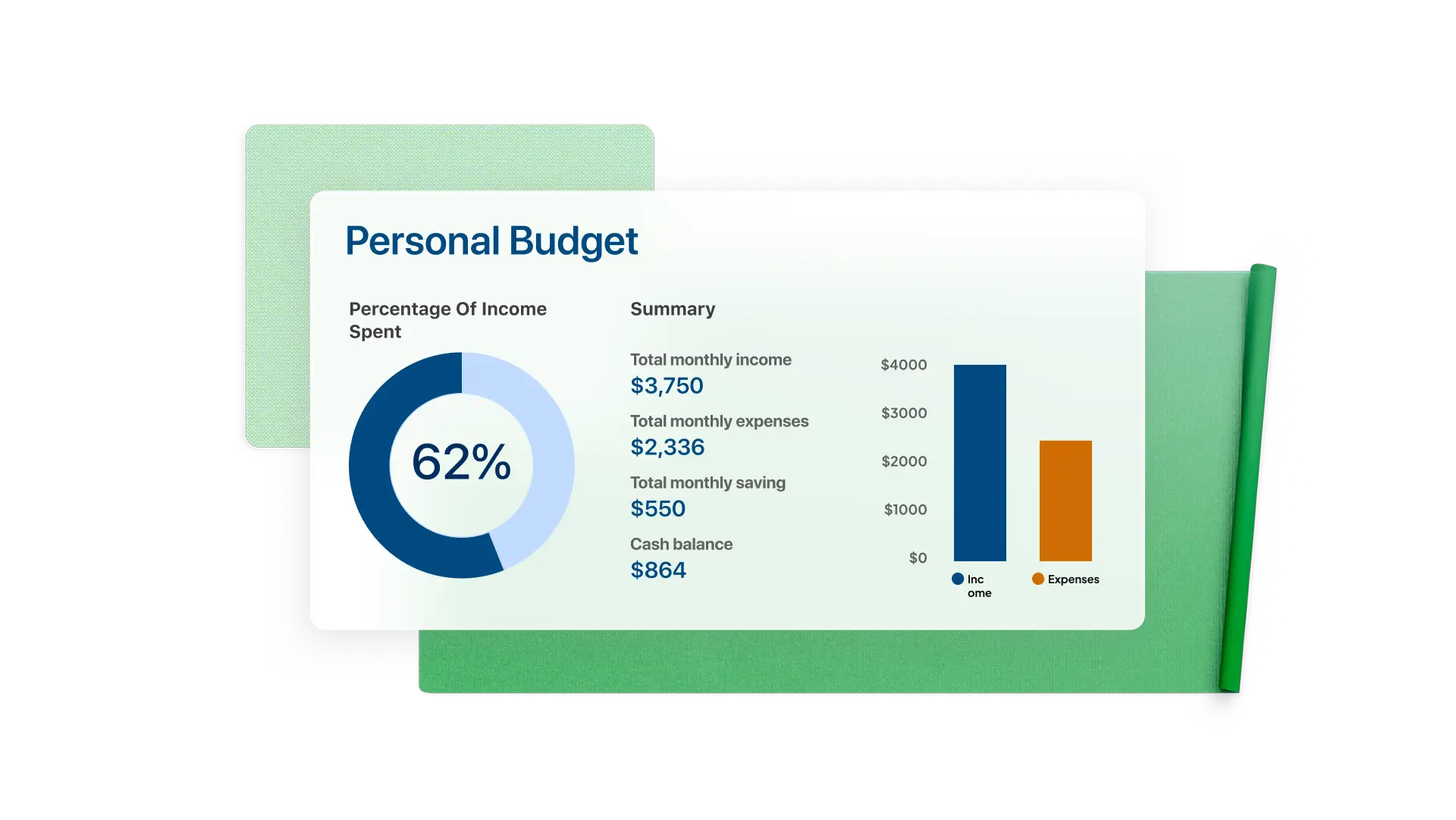

Visualize cash flow

See cash you have on hand automatically in personal budget calculators with built-in formulas. Use graphs to see where you spend the most and get a clear picture of your personal finances with summary tables.

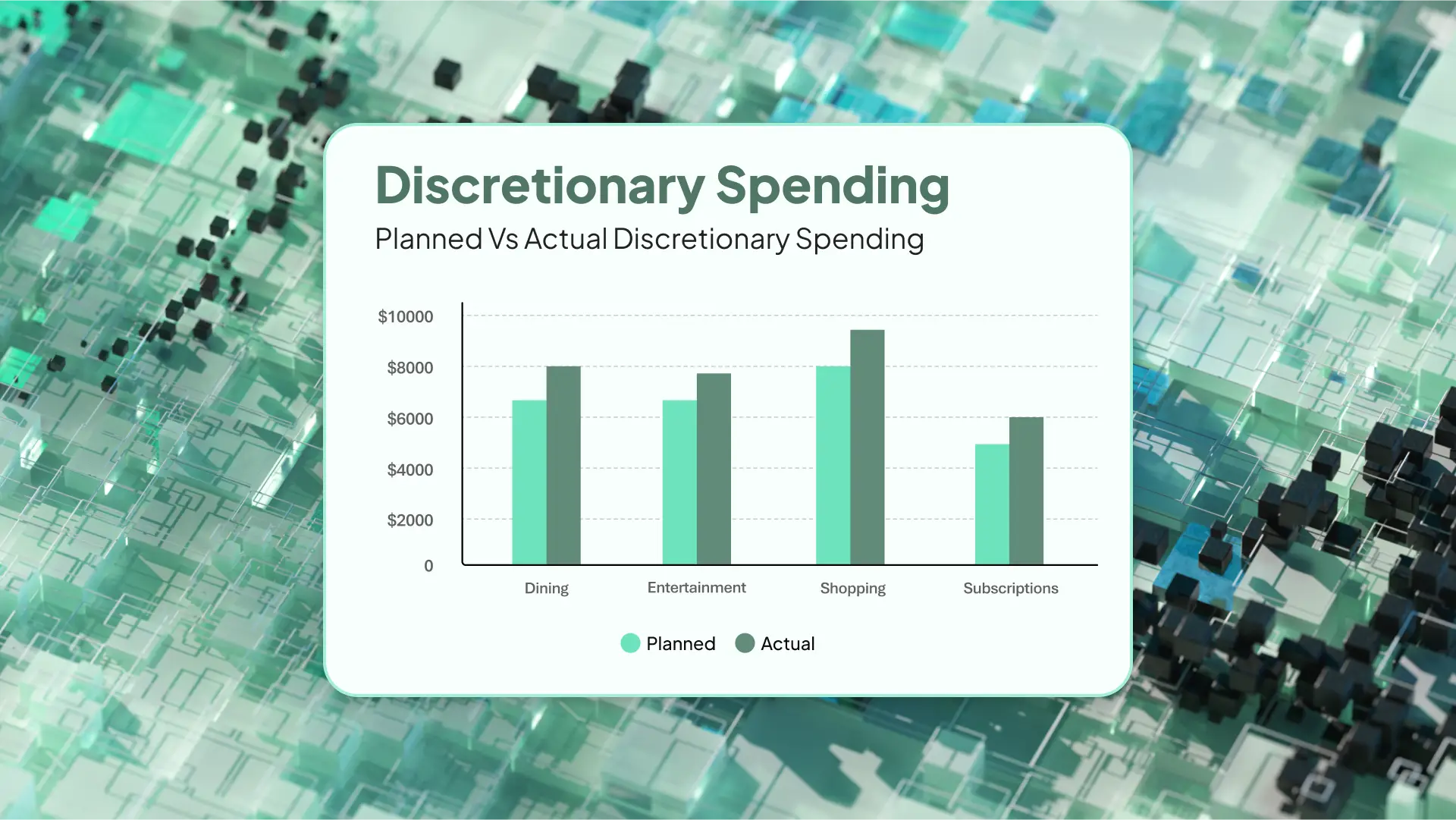

Monitor discretionary spending

Set limits for variable expense categories and compare your planned expenses with your actual spending. Check your budget tracker throughout the month to stay consistent and avoid overspending, even on recurring bills.

Use Copilot for help and insight

Chat with Copilot in Excel to learn how a formula works. Have Copilot suggest actions to accomplish a task, like adding a column to compare spend month over month. Ask Copilot for a summary of your spending habits and ask for any patterns it can see to aid future financial decisions.

Make better financial decisions

Plan accurately for the future based on past spending. Use techniques like zero-based budgeting or the 50/30/20 rule to prioritize saving and paying off debt. Use a budget to gain financial control.

Coordinate family finances

Share budget spreadsheets with family members online to allow co-authoring. Collaborate on a household budget to teach good spending habits and financial literacy to your children. Reduce stress around talking about money and making financial decisions.

How to manage personal finances in Excel

Search the template library for options that align with goals

Customize budget categories like food, housing, transportation, and health

Plan expense category totals and include room for paying debt and saving

Record transactions regularly and update actual expense totals

Review planned vs actual expenses and your total cash flow

Frequently asked questions

How to manage personal finances?

Start by defining your goal, like creating an emergency fund, paying off credit cards, or saving a certain amount by next year. Create a budget with detailed spending categories and set limits for discretionary spending. Use personal finance software or spreadsheets to track every transaction and compare actual spending to your plan.

Why is personal finance important?

Personal finance planning is important to use income efficiently, manage debt, reduce financial stress, and reach your financial goals. With a good financial strategy in place, you can be prepared for challenges like losing a job. You can also take advantage of financial opportunities and feel freer to support causes you care about.

How to keep track of personal finances in Excel?

Use budget spreadsheet templates to keep track of personal finances in Excel. Templates include semi-monthly, monthly, and annual options plus specialized versions for professionals, families, students, and entrepreneurs. Customize templates with your expense categories and income to manage your budget.

How to download personal finances into Excel?

You can add personal finance data into Excel easily by importing CSV files. Many banking and credit card apps also provide statements as standard Excel files. Once you add a table of transactions to your spreadsheet, categorize each transaction to include it in your personal budget.